Since early 2022 rising mortgage rates have taken their toll on house prices. Whether you're selling, buying, or just keeping an eye - this one's for you.

In 2023, an annual fall in house prices has become an almost standard news item around the turn of the month, when Nationwide and Halifax release their latest data. For example, Nationwide reported a yearly fall of 3.3% for house prices in October, despite an unexpected rise of 0.9% for the month alone. Halifax also reported a slightly higher increase at 1.1% for October, but highlighted the figure still represents a 3.2% drop in house prices on last October’s level. The two major mortgage lenders rarely agree on this figure, as each calculates its house price index using their own mortgage data.

A broader measure is published by the Office for National Statistics (ONS), drawing on land registries throughout the UK. Crucially, the ONS covers all UK property sales – mortgaged and unmortgaged – so its database is almost four times the size of Halifax and Nationwide combined. However, the ONS figures receive less attention as they are much slower to emerge – the provisional September data will not be out until mid-November and is likely to be revised in December. There is another time lag relative to the lenders because they use prices at mortgage approval stage, whereas the ONS looks at completed sales. At the time of writing, the ONS’s latest numbers (August 2023) show an annual increase of 0.2%.

Despite the differences in approach, the house price trends recorded by the ONS, Nationwide and Halifax closely follow each other. For instance, Nationwide and Halifax both say house prices peaked in August 2022, whereas the ONS says November 2022 was the high point.

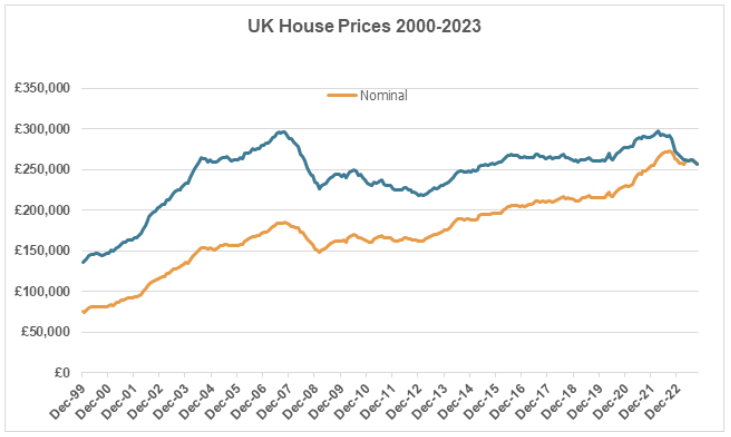

The graph above shows Nationwide’s figures from January 2000 to September 2023. The blue line is more commonly seen and shows the average house price figure since the turn of the century. The orange line is an inflation adjusted version of the blue line, showing how real property prices have grown. This has a much steeper final drop than the blue line because of the recent burst in inflation. It also illustrates a fact that does not make many commentaries about house prices – the average real price today is virtually unchanged from 15 years ago…