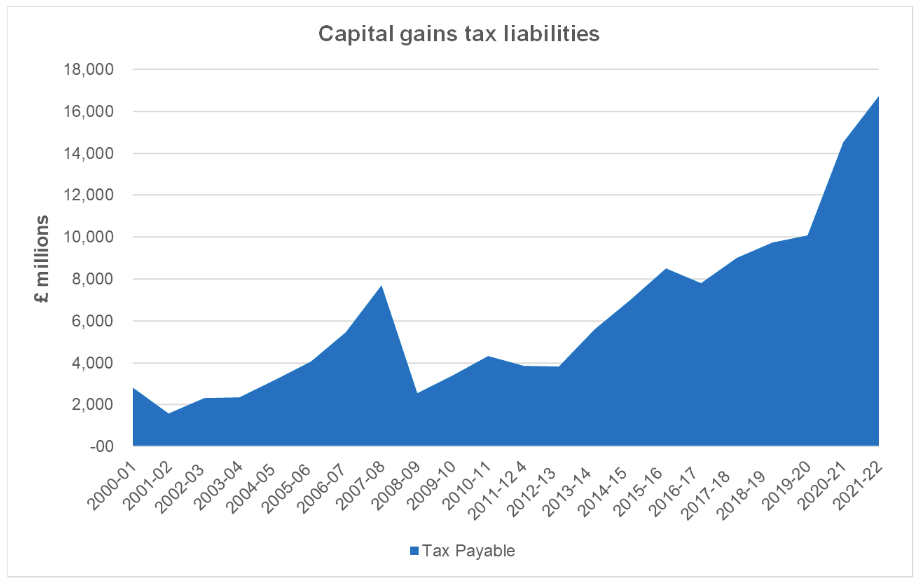

According to HMRC (and their pretty clear graph below), the amount of Capital Gains Tax (CGT) raised over time is on the rise. In 2021/22 £16.7 billion was raised – but what’s behind the statistics and how does it affect you?

Source: HMRC

This record-breaking amount of CGT can be broken down as follows:

- In 2021/22, there were 370,000 individuals liable to CGT and 24,000 trusts. As HMRC notes, this is about 1% of the number of people who pay income tax.

- 45% of all CGT came from an elite group of taxpayers – in fact, less than 1% of all CGT payers – and members of this group all made gains of £5 million or more.

- Some of those realising capital gains in 2021/22 may have been trying to pre-empt an increase in CGT rates: up until the end of November 2021, there was a question mark hanging over the future levels of the tax. Rishi Sunak, Chancellor at the time, had commissioned and received two reports on CGT from the (now defunct) Office of Tax Simplification, but had been sitting on both, keeping taxpayers and their advisers in suspense.

- There was a 56% jump in the taxable sales (and other disposals) of residential property in 2021/22 over the previous tax year, with a corresponding rise in tax liabilities. HMRC data shows that sales remained at virtually the same high level in 2022/23. This could well be confirmation of anecdotal evidence that smaller buy-to-let investors have been selling up in response to tax increases, additional legislative requirements and rising mortgage interest rates.

But what does this mean for you?

If your reaction to these figures is that you never pay CGT and never will, you may need to think again. In 2021/22, the annual exempt amount – the net amount of gains a person could make free of CGT in a tax year – was £12,300. In the current tax year, the exempt amount is £6,000 and from 6 April 2024 it will halve to just £3,000. When these changes were announced last November, HMRC estimated that in this tax year around half a million individuals and trusts could be affected. You too might become part of the CGT statistics.

Tax treatment varies according to individual circumstances and is subject to change.